China’s “Greater Bay Area” Initiative

Executive Summary

The “Greater Bay Area” (GBA) Initiative introduced in February 2019 includes a comprehensive set of new policies in the key areas of R&D, immigration, inbound foreign investment management, cross-boundary financial integration, and IP protection. Initiatives in each area include:

Research & Development:

- Developing the “Guangzhou-Shenzhen-Hong Kong-Macau” innovation and technology corridor (广州-深圳-香港-澳门科技创新走廊) to foster a supportive environment for innovation and entrepreneurship growth.

Immigration:

- Launching a skilled immigration pilot program for foreign innovation talent.

- Starting a pilot scheme to offer “national treatment (国民待遇)” to foreign innovation talent setting up technology enterprises in the GBA.

- Introducing individual income tax cuts to foreign talent working in the GBA.

Opening up to inbound foreign investment:

- Affirming the use of pre-entry national treatment (准入前国民待遇) plus negative list management (负面清单) in governing the market entry of foreign investors and businesses.

- Encouraging investment from foreign companies operating in advanced manufacturing (e.g., automotive), emerging high-tech industries (e.g., 5G and AI industries) and modern services (e.g., fintech).

Cross-boundary financial integration:

- Promoting cross-boundary transactions of funds, insurance and reinsurance products.

- Promoting cross-boundary renminbi business in the GBA.

- Encouraging domestic innovation and technology enterprises to seek public listing and private equity investment from Hong Kong.

IP protection:

- Promoting cross-boundary cooperation among Hong Kong, Macau and Guangdong Province in enforcing IP protection and training IP professionals.

As is discussed in the following report, the GBA Initiative is expected to generate broad business opportunities in the technology and financial services sectors for foreign businesses and investors.

Background

Under the “One Nation, Two Systems” agenda, the Pearl River Delta Region – including Hong Kong, Macau and Guangdong Province – has fallen short of becoming a unified and efficient regional economy. In this region of merely 56,500 square kilometres, there are two distinct political systems, three separate tax jurisdictions and three different legal regimes.[1] This diversity of regulatory regimes has generated challenges and even impediments to the cross-boundary exchange of capital, goods, technology, information and talent between Mainland China, Hong Kong and Macau.[2]

The Pearl River Delta Region and its mainland cities have historically been the centre for traditional light and heavy manufacturing industries (e.g., textiles, toys, chemical products and automotive).[3] Although this region has been undergoing economic transition since the 2010s, most of the local cities still remain heavily reliant on traditional manufacturing industries, with only Hong Kong and Shenzhen successfully transitioning themselves into innovative service economies.[4]

The Pearl River Delta Region and its mainland cities have historically been the centre for traditional light and heavy manufacturing industries (e.g., textiles, toys, chemical products and automotive).[3] Although this region has been undergoing economic transition since the 2010s, most of the local cities still remain heavily reliant on traditional manufacturing industries, with only Hong Kong and Shenzhen successfully transitioning themselves into innovative service economies.[4]

To develop the Pearl River Delta into a more unified, innovative and competitive economy – and to support the Belt and Road Initiative – as early as 2015 the Chinese government began considering establishing a “bay area” economy in this region, using as a model other world-class “bay areas” such as New York, San Francisco and Tokyo that have successfully promoted economic development and innovation. In February 2019, the Central Committee of the Party (党中央) and the State Council (国务院) jointly released the Outline Development Plan for the Guangdong-Hong Kong-Macau Greater Bay Area (粤港澳大湾区发展纲要, hereinafter referred to as the GBA Plan), and announced the formal launch of the Greater Bay Area (GBA) Initiative.[5] This report highlights the policies and measures to be implemented under the initiative, and explores how Canadian businesses can benefit from it.

What is the “Greater Bay Area” Initiative?

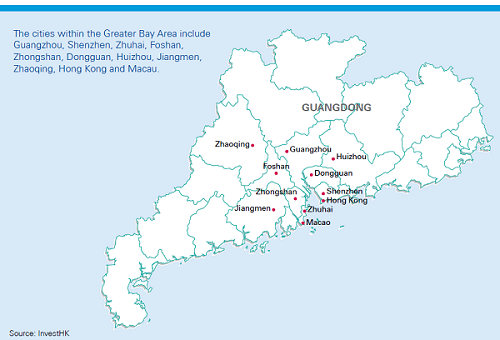

As a national strategic project, the GBA includes the Special Administrative Regions of Hong Kong and Macau, as well as nine mainland cities located around the Pearl River Delta: Guangzhou (广州), Shenzhen (深圳), Zhuhai (珠海), Dongguan (东莞), Huizhou (惠州), Zhongshan (中山), Foshan (佛山), Jiangmen (江门) and Zhaoqing (肇庆). In principle, the GBA is to become a highly coordinated and multi-functional regional economy, with each municipality playing a differentiated role.

Strategic goals:

The GBA Initiative is designed to achieve five important goals:[6]

- To build a world-class city cluster in the Pearl River Delta region (建立珠三角世界级城市群);

- To become a global technology and innovation hub;

- To support the implementation of the Belt and Road (一带一路) Initiative;

- To deepen cooperation among Mainland China, Hong Kong and Macau in the Qianhai, Nansha and Hengqin development zones (深圳蛇口前海自贸区,广州南沙自贸区,珠海横琴自贸区); and

- To build a quality living environment that is suitable for residents as well as business and tourism.

Ultimately, China plans that by 2035, the Pearl River Delta Region will become a world-class bay area and a globally competitive high-tech economy with very efficient flow of resources and factors of production throughout the region.[7]

Differentiated roles of the GBA municipalities

According to the GBA Plan, Hong Kong –known as the global financial and offshore RMB business hub, and the “gateway” into China – will continue to serve as the major channel for the cross-boundary exchange of capital, technology, information and talent between China and the rest of the world. It will also establish itself as the centre for “international legal and dispute resolution services in the Asia-Pacific region.”[8] Macau will not only become a tourism and leisure centre, but also capitalize on its Portuguese community and serve as the “commerce and trade cooperation service platform between China and Lusophone [Portuguese-speaking] countries.”[9]

As for the nine mainland cities, Shenzhen is designed to become China’s Silicon Valley, while Guangzhou will become an “international commerce and industry centre and integrated transport hub.”[10] Guangzhou will also be the centre of culture and technology education.[11] Furthermore, depending on their specific strengths, the remaining seven mainland cities will play complementary roles in supporting the GBA’s economic transition.[12] Overall, by assigning different roles to of each of the GBA cities, the Chinese government aspires to establish a highly coordinated and multifunctional regional economic zone in GBA.

What policies will be brought forward?

To achieve these strategic goals, the Chinese government plans to introduce a comprehensive set of new policies in such areas as R&D, immigration, inbound foreign investment management, cross-boundary financial integration and IP protection.

Research & Development

According to the GBA Plan, China will establish a regional R&D platform, which will be known as the “Guangzhou-Shenzhen-Hong Kong-Macau” innovation and technology corridor (广州-深圳-香港-澳门科技创新走廊). This corridor will foster a supportive environment for innovation and entrepreneurship growth to promote the development of a Chinese equivalent to Silicon Valley, and it will include:[13]

- Greater Bay Area big data centre;

- Technology parks for R&D and innovations, such as the Hong Kong-Shenzhen Innovation and Technology Park (港深创新及科技园) and the Sino-Singapore Guangzhou Knowledge City (中新广州知识城);

- Five R&D centres in Hong Kong, respectively for logistics and supply chain technologies, textiles and apparel innovation, ICT, automotive parts, and nano and advanced materials; and

- Partner State Key Laboratories (国家重点实验室伙伴实验室) in Hong Kong and Macau.

Along this corridor, Hong Kong, Macau and Guangdong Province will jointly establish mechanisms to bring consistency to cross-boundary innovation and entrepreneurship exchanges.[14]

Immigration

China seeks to attract foreign talent and expertise to develop the R&D platform outlined above. Most notably, China plans to launch a skilled immigration pilot program to create a convenient and regular pathway for foreign individuals to settle in the Pearl River Delta Region. This program will be the first of its kind in the PRC’s history. China further promises to start a pilot scheme that will “offer national treatment [国民待遇] to foreign innovation talents [in] setting up technology enterprises.”[15] The country also pledges to encourage foreign investors to establish R&D institutes and innovation platforms in Hong Kong, Macau and Guangdong.[16]

In March 2019, a new tax incentive policy was introduced to incentivize foreign talent to work in Mainland China with the March 14, 2019 joint issuance from the Ministry of Finance (财政部) and State Administration of Taxation (国家税务总局) of the Notice of the Preferential Individual Tax Cut Policies for Guangdong-Hong Kong-Macao Greater Bay Area (关于粤港澳大湾区个人所得税优惠政策的通知, also known as “Notice 31”).[17] Accordingly, foreign talent working in Mainland cities within the GBA will pay the same tax as they would for equivalent positions in Hong Kong and Macau – with the outstanding taxed amount reimbursed by the provincial government of Guangdong.[18] This will result in a substantial cut of the individual tax burden for foreign talent working in Mainland China, as the top individual tax rate in Mainland China is 28% higher than that in Hong Kong.[19]

Inbound foreign investment

The GBA Plan reaffirms China’s willingness to open up to foreign investment, stating that pre-entry national treatment (准入前国民待遇) plus negative list management (负面清单) will be used to govern the market entry of inbound foreign investment.[20] As for who will be encouraged to invest in the GBA, China is prioritizing investment from foreign companies that operate in advanced manufacturing (e.g., automotive), emerging high-tech industries (e.g., 5G and AI industries) and modern services (e.g., fintech).[21]

Financial integration

Another key aspect of the GBA Plan is the promotion of regional financial integration across the Pearl River Delta Region. China plans to undertake concrete measures to promote the cross-boundary exchange of capital and funds, and even to pursue a unified regional financial market throughout the GBA. Most notably, China pledges to:

- Promote cross-boundary transactions of funds, insurance and reinsurance products (e.g., auto insurance and health insurance products);[22]

- Support Hong Kong and Macau banks and insurance institutions in setting up operations in the Qianhai, Nansha and Hengqin development zones (深圳前海,广州南沙,珠江横琴自贸区);[23]

- Encourage the cross-boundary use of renminbi in the GBA, particularly by supporting banks to engage in cross-boundary renminbi interbank lending, renminbi foreign exchange spots and forward businesses, and related renminbi derivative products;[24]

- Support Hong Kong institutional investors to freely raise renminbi funds in the GBA for capital investment;[25] and

- Encourage domestic innovation and technology enterprises to seek public listings and private equity investment from Hong Kong.[26]

In its pursuit of building a unified regional financial market, China plans to reduce the financial regulatory differences among Hong Kong, Macau and Guangdong Province. In particular, as noted by the GBA Plan, Hong Kong, Macau and Guangdong Province will jointly establish “a Greater Bay Area coordination and communication mechanism for financial regulation, and strengthen cooperation in the monitoring of financial institutions as well as the monitoring and analysis of cross-boundary capital flows.”[27] Nevertheless, there is a lack of detail in the GBA Plan about how this cross-boundary regulatory coordination will operate in practice.

IP protection

To improve domestic IP protection, China plans to establish a comprehensive cooperation mechanism for enforcing cross-boundary IP protection in the Pearl River Delta Region. Under this mechanism, the legal enforcement departments of Hong Kong, Macau and Guangdong Province will collaborate closely to enforce IP protection in areas such as e-commerce, import & export, and IP dispute resolution. These three entities are also encouraged to foster cross-boundary partnership in training IP professionals.[28]

Moreover, the GBA Plan emphasizes the importance of Guangzhou and Hong Kong in cross-boundary IP protection. Hong Kong will serve as a regional IP trading and dispute resolution centre, providing invaluable expertise in alternative IP dispute resolution, including arbitration, mediation and consultation.[29] Guangzhou’s legal enforcement departments, including its Intellectual Property Court (广州知识产权法院), will specialize in managing IP infringement cases in the Pearl River Delta Region.[30]

What will the GBA Initiative mean to Canadian business?

A transitioning regional economy with growing opportunities

Under the GBA Initiative, the Pearl River Delta Region is expected to transition into an innovative and globally competitive regional economy. As estimated by the China-based think tank “China-Center for International Economic Exchanges,” by 2020, the total GDP of the GBA could rise to the same level as that of the Tokyo Bay Area (which was the largest bay area economy in 2017 in terms of GDP). By 2030, the GBA will become the world’s leading financial and innovation hub, and its GDP is expected to reach US$2.2 trillion.[31]

As the GBA is on the path of rapid economic and technological development, its local technology and financial services sectors have promising market potential. The Guangdong provincial government predicts that by 2020, the total output value of high-tech industries in Guangdong will reach 1.5 trillion RMB.[32] Some particularly promising industries are described below:

Artificial Intelligence:

In recent years, with strong government support, the AI industry in the GBA has grown rapidly. According to government estimates, the market scale of Guangdong’s AI industry was estimated to be 26 billion RMB in 2017 and is expected to rise to 50 billion RMB in 2020 and 150 billion RMB in 2025.[33]

The commercialization of AI technologies has created extensive market opportunities in other sectors of the GBA. As noted in a report by Deloitte, AI-related products like autonomous robots are playing increasingly important roles in the GBA’s traditional manufacturing sectors – particularly in the automotive, logistics and packaging industries. Meanwhile, local innovators in the GBA have been seeking to apply AI technologies in healthcare, entertainment and other service sectors. In 2017, the commercialization of AI technologies generated a value of 200 billion RMB in the GBA[34].

The commercialization of AI technologies has created extensive market opportunities in other sectors of the GBA. As noted in a report by Deloitte, AI-related products like autonomous robots are playing increasingly important roles in the GBA’s traditional manufacturing sectors – particularly in the automotive, logistics and packaging industries. Meanwhile, local innovators in the GBA have been seeking to apply AI technologies in healthcare, entertainment and other service sectors. In 2017, the commercialization of AI technologies generated a value of 200 billion RMB in the GBA[34].

There is little doubt that foreign businesses and innovators will be able to seize business opportunities in AI and its associated industries, particularly given the emphasis in the GBA Plan on the need for attracting foreign investment in advanced manufacturing and emerging high-tech industries. Furthermore, there have been precedents in which foreign high-tech companies have been invited to set up business and even R&D centres within the GBA. In February 2019, European aerospace giant Airbus established an aerospace technology innovation centre in Shenzhen that is Airbus’s first in Asia and second worldwide.[35]

Fintech:

In recent years, the fintech sector – which includes mobile payments, AI-powered finance advisory, cloud finance and other financial services that use emerging technologies – has dramatically expanded in China. In 2018, the market size of China’s fintech sector was more than 115 trillion RMB; and this figure is expected to rise to 157 trillion RMB by 2020.[36] As China’s leading finance and innovation centre, the GBA possesses huge market potential in the developing fintech sector.

The fact that the GBA Initiative aims for regional financial integration will further fuel the growth of the fintech sector in the Pearl River Delta Region. HSBC estimates that by 2025, the world’s largest inter-city banking network will emerge in the GBA, and that the total revenue of the GBA’s banking sector will rise to US$185 billion.[37] Given the growing demand for cross-boundary financial services, fintech companies will be increasingly relied on to ensure that these services are provided in an effective, efficient and coordinated manner.

It is important to note that both domestic and foreign companies will benefit from the rapid growth of fintech. There are already examples of Sino-foreign cooperation in this sector: in 2018, Standard Chartered PLC partnered with its Chinese peers – including the Bank of China, the Construction Bank, and China Merchants Bank – and successfully innovated the GBA’s first trade finance blockchain platform (粤港澳大湾区贸易金融区块链平台).[38] In the future, foreign fintech companies, with their advanced technology and expertise, will surely have opportunities to play in the GBA’s fintech sector.

Challenges

The primary challenge to success of the GBA Initiative is, and will continue to be, the differing regulatory regimes between Mainland China and the Special Administrative Regions. One clear example of this challenge is in the area of data transfer. Hong Kong currently imposes few restrictions on the cross-border transfer of business and personal data.[39] On the other hand, under the guidance of Cybersecurity Law (introduced in 2017), Mainland China has generally restricted, if not fully prohibited, businesses from sharing data internationally.[40] This restriction on cross-border data transfers, as reported by the British Chamber of Commerce in China , has effectively isolated China from the rest of the world.[41] Given these divergent attitudes towards cross-border data transfer, it remains difficult to know how Mainland China and Hong Kong can implement the GBA Initiative and ensure smooth cross-boundary transfers of data and information.

Conclusion: What is the next step?

Overall, the GBA Initiative is likely to bring broad business opportunities in the technology and financial services sectors to Canadian businesses and investors. Nevertheless, as the GBA Initiative remains at a very early stage, to better understand how it will impact business operation and investment, we recommend Canadian businesses and entrepreneurs address the following:

- Consult with your law firm to identify specific business opportunities in which foreign investment is allowed, so as to minimize the risk of contravening Chinese laws, regulations or policies.

- Learn about and attend government-sponsored conferences and forums: every year, Chinese government authorities will attend and even host public conferences to disseminate policy updates and to seek recommendations for developing the GBA Initiative. Most notably, on December 29, 2018, a public conference called “the First Guangdong-Hong Kong-Macau Development Forum (首届粤港澳大湾区发展论坛)” was hosted in Guangzhou, with senior officials from the National Reform and Development Commission (国家发展与改革委员会) attending and making presentations.[42] Attending these conferences and engaging in discussions with government authorities can be a useful way to understand how China is going to develop the GBA.

July 3, 2019

References:

[1]新华网, “一二三四”:粤港澳大湾区建设的优势与难点在博鳌引热议”, April 9, 2018.

[2]香港政府新闻网,参与湾区发展,实践一国两制, May 11, 2019.

[3]HKTDC, 珠三角經濟概況, May 10, 2018.

[4]Deloitte, 从‘世界工厂’到‘世界级湾区’—— 粤港澳大湾区发展建议,February 2018, p. 7

[5] Winston and Straw LLP, Greater Bay Area Initiative to Create Opportunities for Insurers.

[6] KPMG, Greater Bay Area Update: Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, February 2019, p. 1.

[7]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 9.

[8]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 12.

[9]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 12.

[10]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 12.

[11]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 12.

[12]Forbes, 详解粤港澳大湾区:惊涛骇浪中的百年机遇, March 29, 2019.

[13]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, pp. 15 & 17.

[14]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, pp. 15 & 17.

[15]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p 37.

[16]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, pp. 16-17.

[17]Deacons, 吸引境外人才的稅收激勵政策 – 關於在中國境內無住所個人的個人所得稅新規

[18]South China Morning Post, Lower Taxes and Subsidies as Beijing Rolls Out New Measures to Greater Bay Area Cities, March 2, 2019.

[19]South China Morning Post, Lower Taxes and Subsidies as Beijing Rolls Out New Measures to Greater Bay Area Cities, March 2, 2019.

[20]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 39.

[21]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 29.

[22]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 29.

[23]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 29.

[24]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 29.

[25]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 29.

[26]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 18.

[27]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 30.

[28]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 19.

[29]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, pp. 12 & 19.

[30]Great Bay Area, Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, p. 19.

[31]EY, 粤港澳大湾区——蓄势待发,剑指成功, 2018, pp. 4 & 6.

[32]Deloitte China,大湾区发展纲要解读,April 25, 2019, p. 21.

[33]Deloitte China,大湾区发展纲要解读,April 25, 2019, pp. 17 & 18.

[34]Deloitte China,大湾区发展纲要解读,April 25, 2019, p. 17.

[35]China Daily, Bay Area Gearing Up for a Wider Branding of Global Investors, May 17, 2019.

[36]Forward The Economist, 2018年中国金融科技行业市场概况和发展前景分析,Fintech列入十三五规划, March 27, 2019

[37]新浪财经, 2025年粤港澳大湾区银行业收入预计将达1850亿美元, February 23, 2019.

[38]KPMG, 粤港澳大湾区银行业报告,May 16, 2019, p. 35.

[39]iapp, International Association of Privacy Professionals, “Hong Kong Puts Restrictions on Cross-Border Transfers: Are You Compliant?

[40]British Chamber of Commerce in China, 2019 Position Paper, p. 59.

[41]British Chamber of Commerce in China, 2019 Position Paper, p. 28.

[42]GUOSOON, 首届粤港澳大湾区发展论坛(世界湾区论坛)在广州成功举办, December 29, 2018.