Canada – China Trade in Q3 2025

Highlights

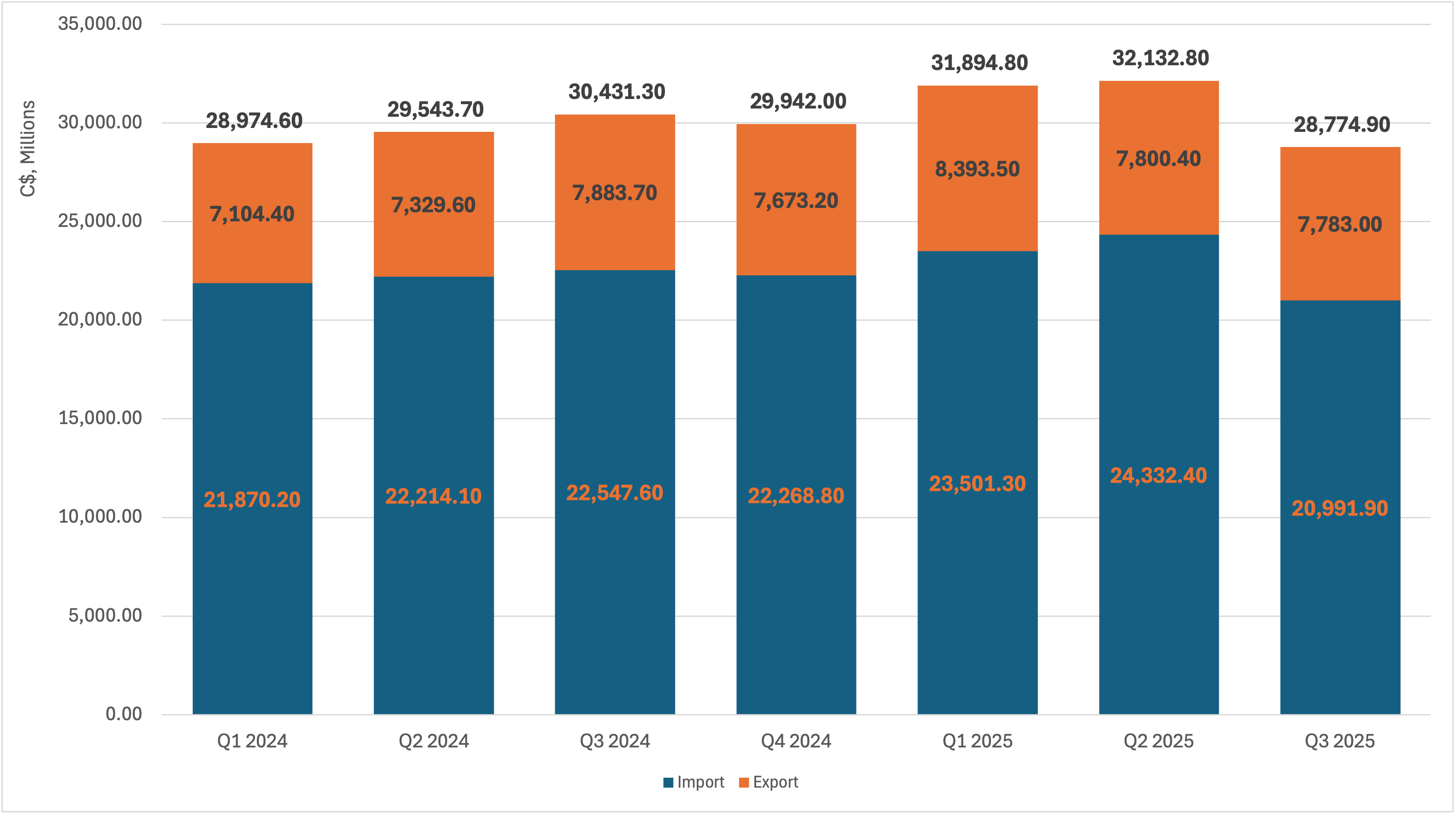

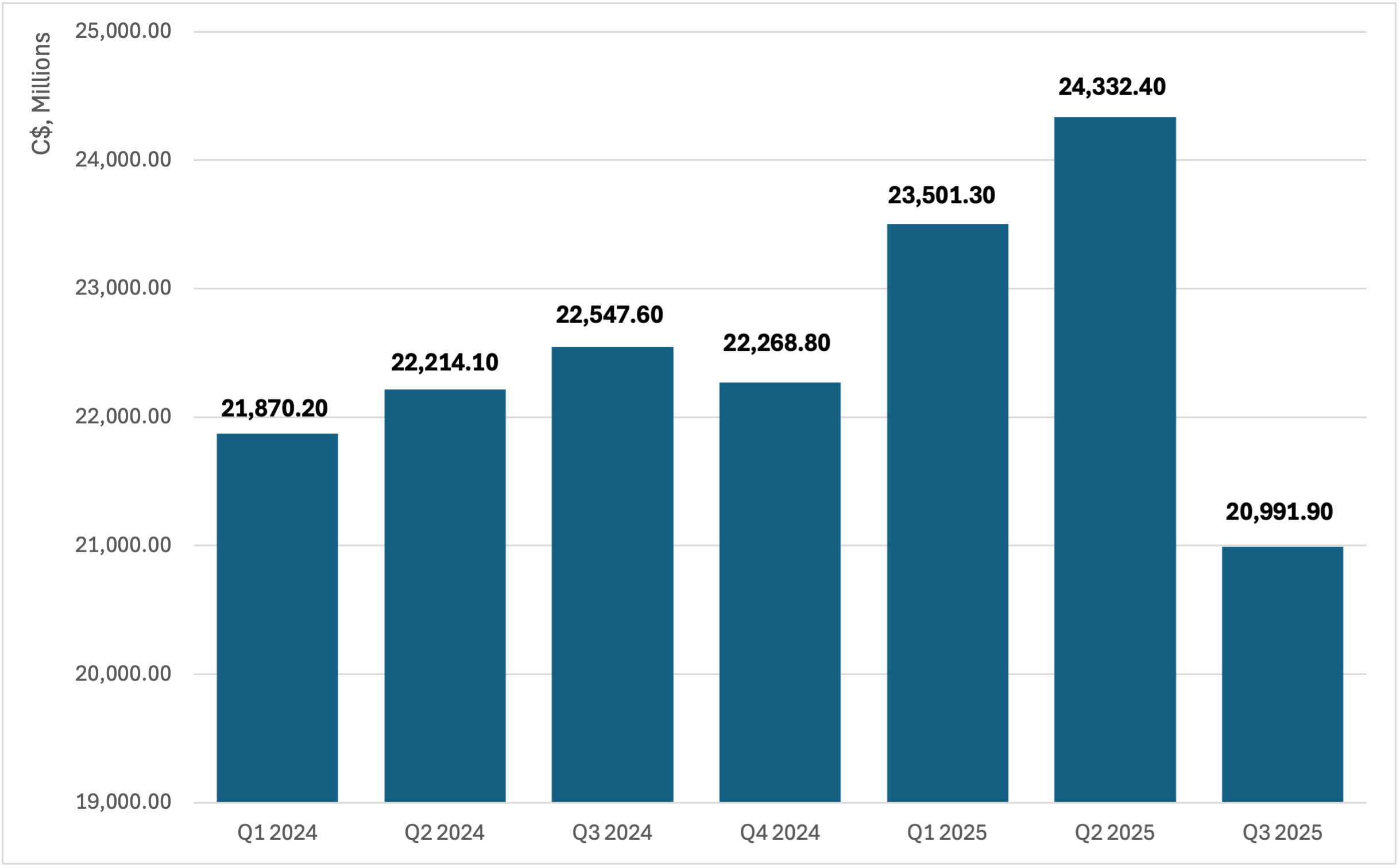

- Bilateral Trade Declined Sharply: Canada–China bilateral trade reached C$28.8 billion in 2025 Q3, falling 10.5% from Q2, driven by a sharp drop in imports.

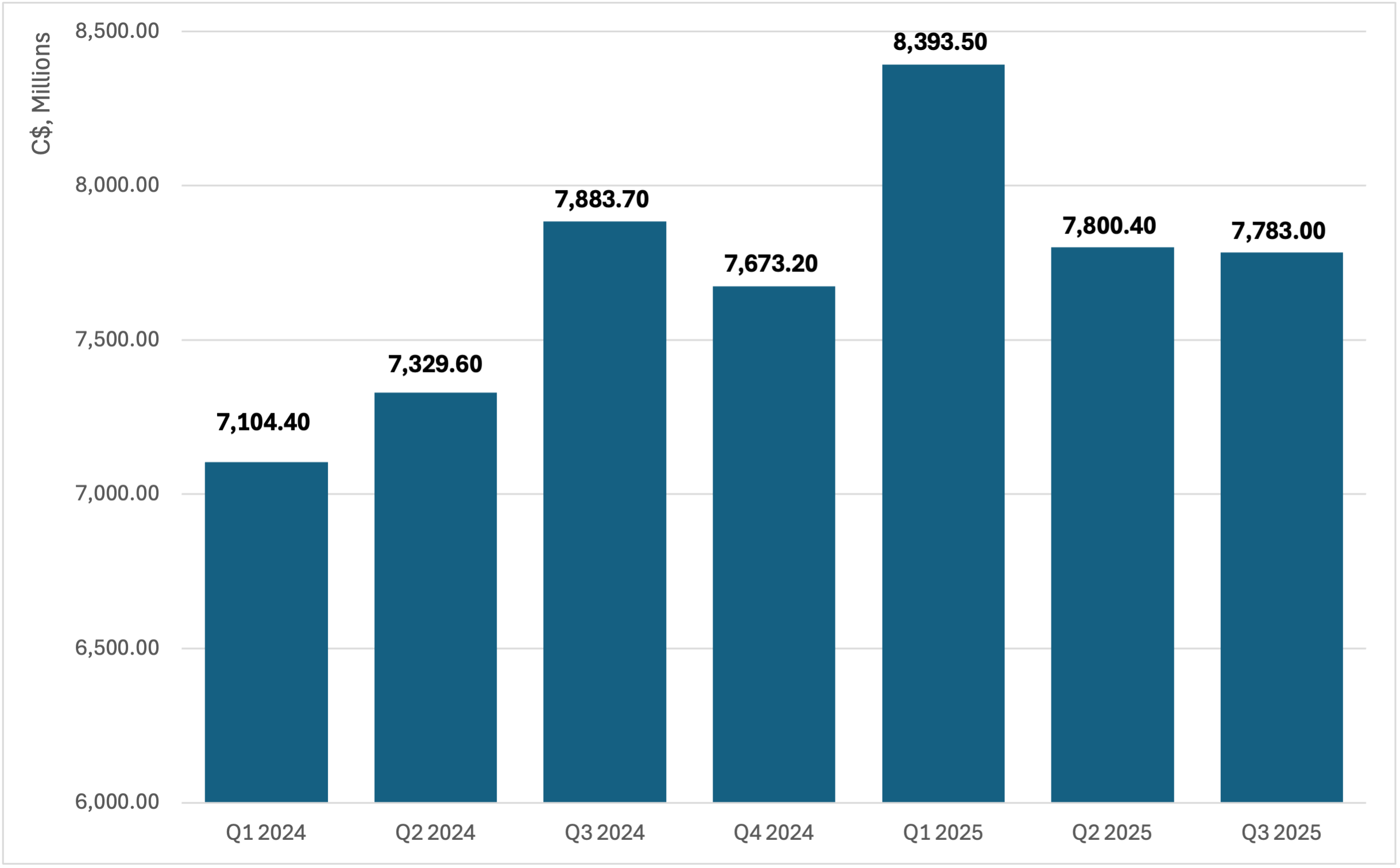

- Import-Led Weakness: Imports from China fell 13.7% quarter-over-quarter, while exports to China were broadly stable.

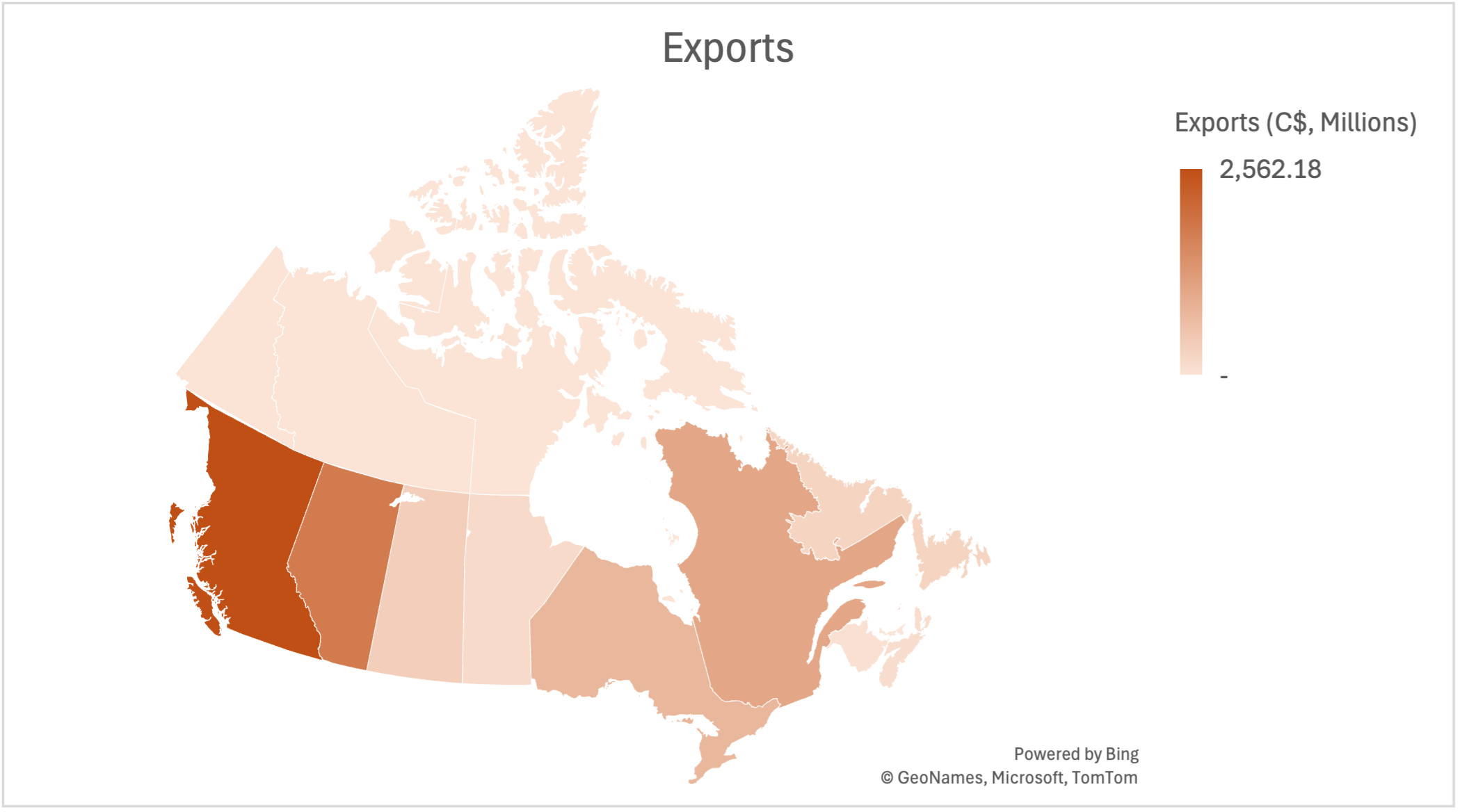

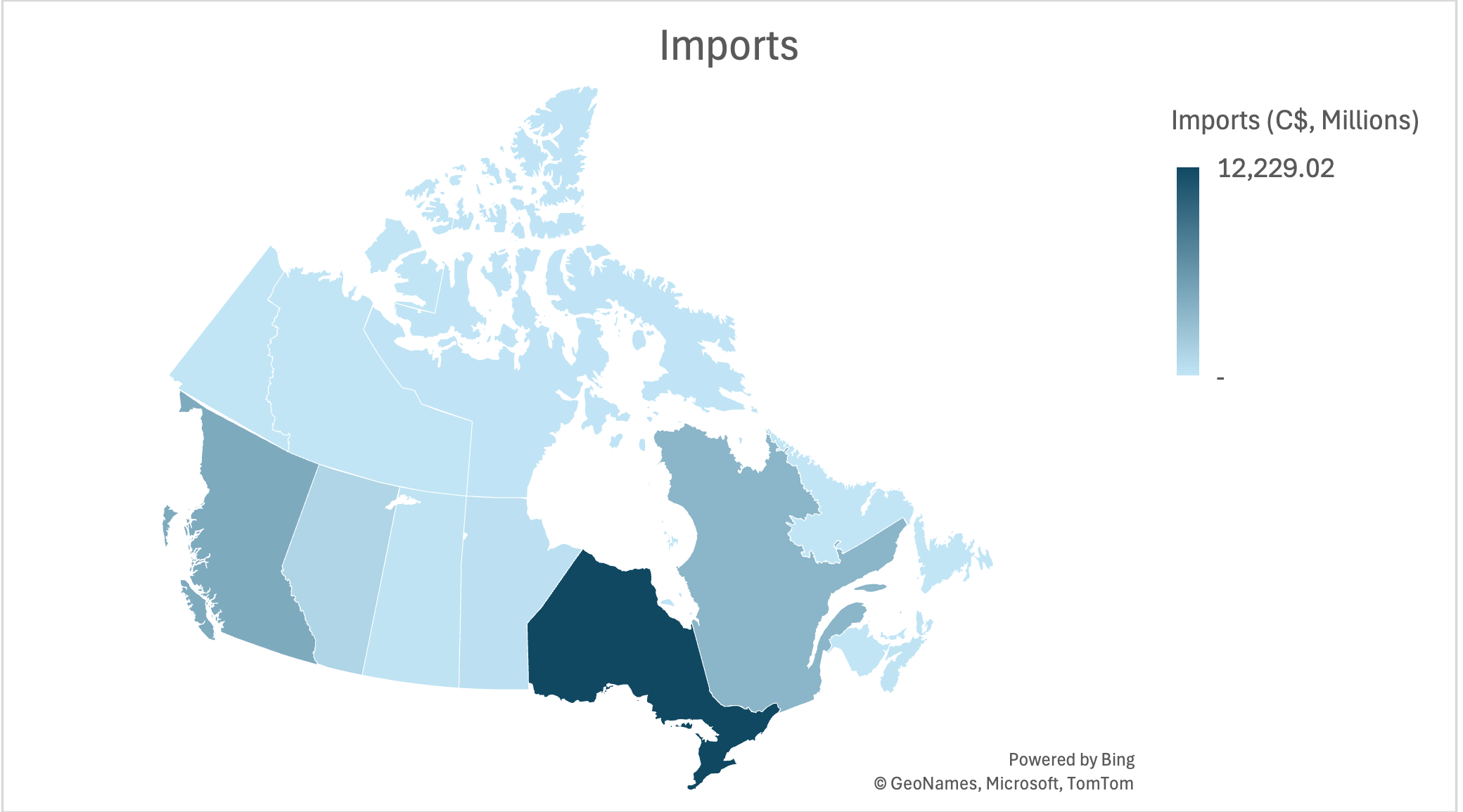

- High Geographic Concentration: Bilateral trade remained concentrated in Ontario and British Columbia, accounting for roughly 44% and 24% of the total, respectively.

- Export Product Composition Shifted: The sharp drop in agricultural exports drove the overall decline in exports, pushing the category to 4th place, while energy exports rose to become Canada’s largest export to China.

Authors

Dr. Xiaowen Zhang, Senior Researcher, The China Institute, University of Alberta

Dr. Weisu Yu, Postdoctoral Scholar, The China Institute, University of Alberta

Overall Trend

Canada–China bilateral trade fell sharply in Q3 2025 to C$28.8 billion, down 10.5% from Q2 and 5.44% lower than a year earlier, driven mainly by a steep drop in Canadian imports from China. Imports declined 13.7% quarter-over-quarter and 6.9% year-over-year, reaching C$21 billion, while exports to China were broadly stable, edging down just 0.2% from Q2 and remaining in line with Q3 2024 at C$7.8 billion. This divergence suggests a weaker Canadian demand for Chinese goods, while Chinese demand for Canadian goods remains resilient.

Figure 1. Canada–China Bilateral Trade, 2024 Q1–2025 Q3 [1]

Figure 2. Canadian Exports to China, 2024 Q1–2025 Q3 [2]

Figure 3. Canadian Imports from China, 2024 Q1–2025 Q3 [3]

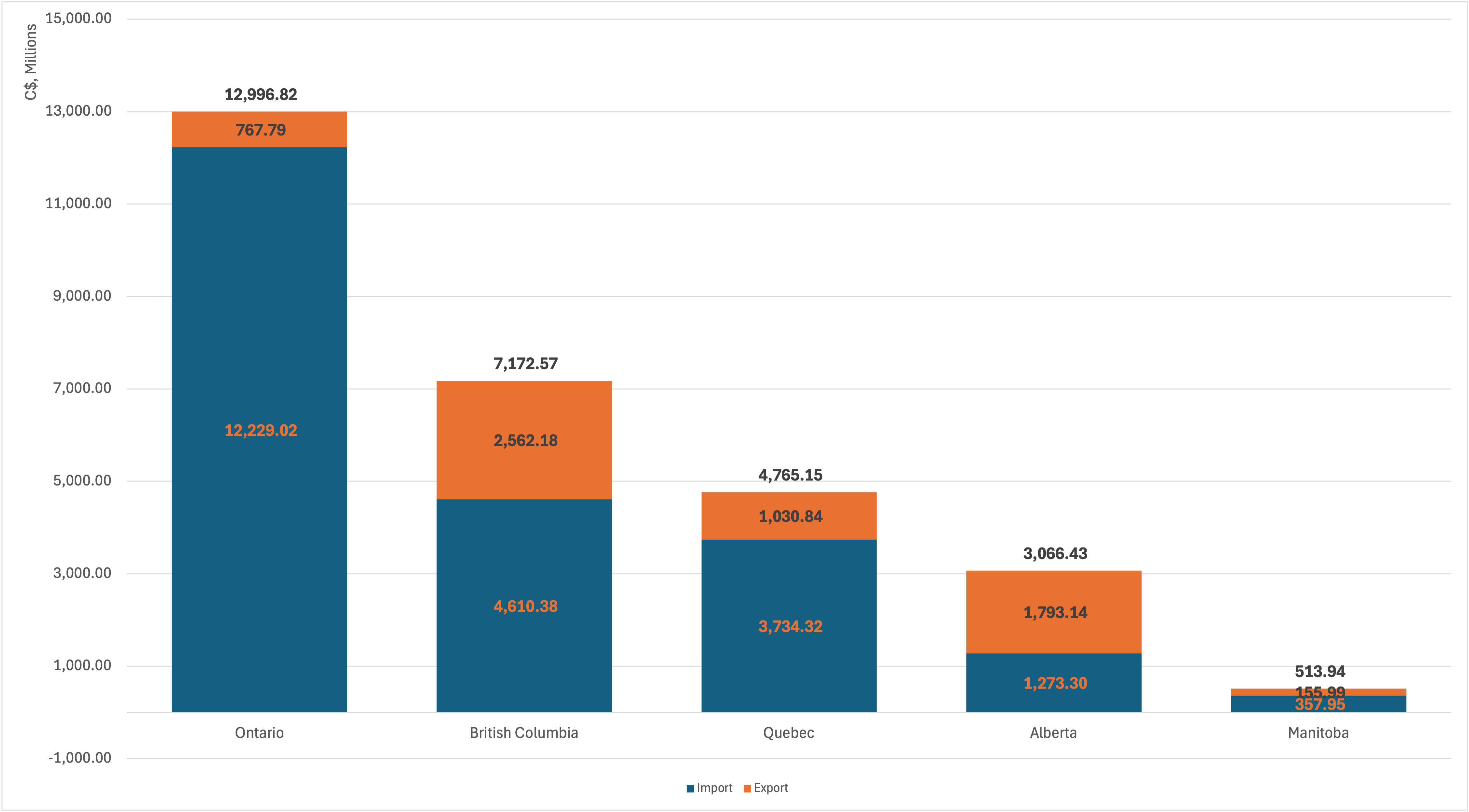

Provincial Distribution

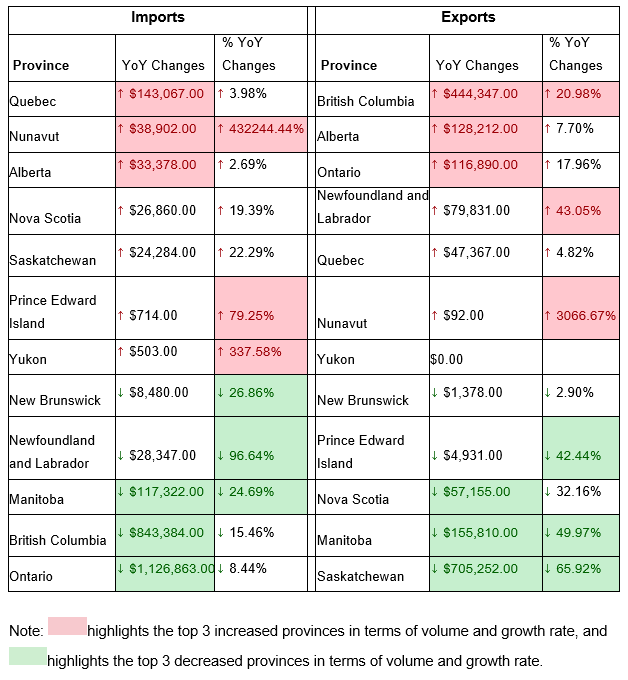

Trade remained highly concentrated. Ontario and British Columbia dominated bilateral flows, accounting for roughly 44% and 24% of total bilateral trade value, respectively. Ontario’s trade is heavily import-driven, representing more than half (approximately 54%) of Canada’s total imports from China; B.C. shows a more balanced profile, with a slightly stronger role on the export side (36% of total exports to China) relative to its share of total imports (20%). Quebec and Alberta recorded significantly smaller volumes relative to ON and BC, contributing only about one-quarter of total bilateral trade with China combined (16% and 10%, respectively). Structurally, Quebec is largely import-oriented (16% of total imports), and Alberta is more export-focused but limited in scale (25% of total exports).

One notable development was Saskatchewan’s 65.8% year-on-year decline in exports, driving down its share in Canada’s total exports to China from 15% in 2024 Q3 to 5% in 2025 Q3, consistent with the collapse in agricultural shipments to China following tariff disputes, particularly on canola. The other major export provinces — BC, AB, and QC — experienced increases of C$444.4 million (↑20.1% YoY), C$128.2 million (↑7.7% YoY), and C$47.4 million (↑4.8% YoY) in their exports to China, respectively, while Manitoba (↓C$155.8 million, ↓50% YoY) and Nova Scotia (↓C$57.2 million, ↓32.2% YoY) registered significant declines. These shifts intensified the geographic concentration of exports to China. Import-wise, ON, BC, and Manitoba registered significant drops in their imports from China, down by C$1.13 billion (↓8.8% YoY), C$843.4 million (↓15.5% YoY), and C$117.3 million (↓24.7% YoY), respectively. The import declines in these provinces align with the national drop in motor vehicles and parts (↓38% YoY), electronic equipment (↓14% YoY), and consumer goods (↓5% YoY) — categories concentrated in their import profiles. The broad-based nature of the import decline across major importing provinces suggests demand-side softening rather than province-specific factors, though the timing also coincides with heightened trade policy uncertainty.

Overall, Q3 trade remained concentrated in Canada’s largest trading provinces, underscoring the continued geographic concentration of Canada–China trade.

Figure 5. Top 5 Provincial Bilateral Trade, 2025 Q3 [5]

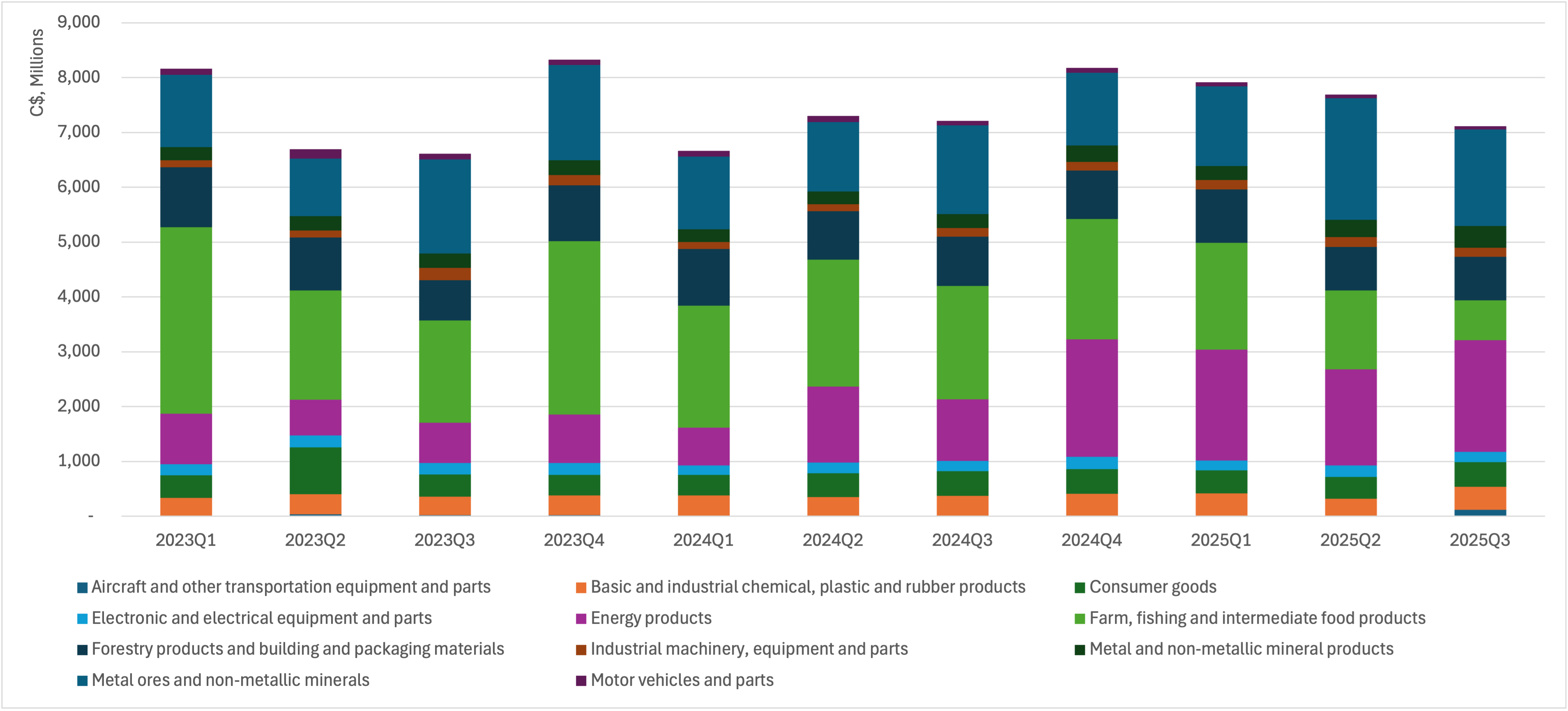

Products Composition

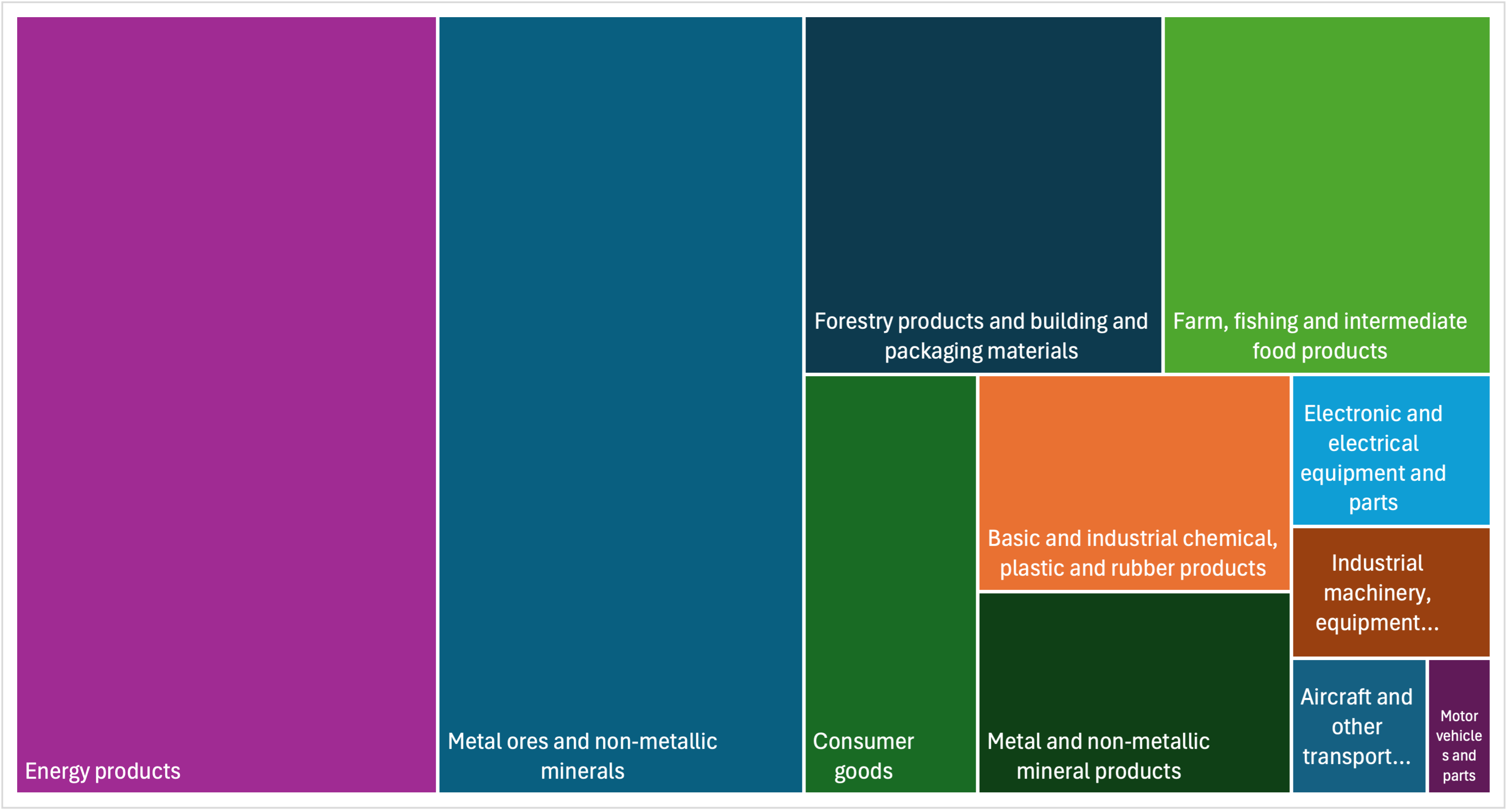

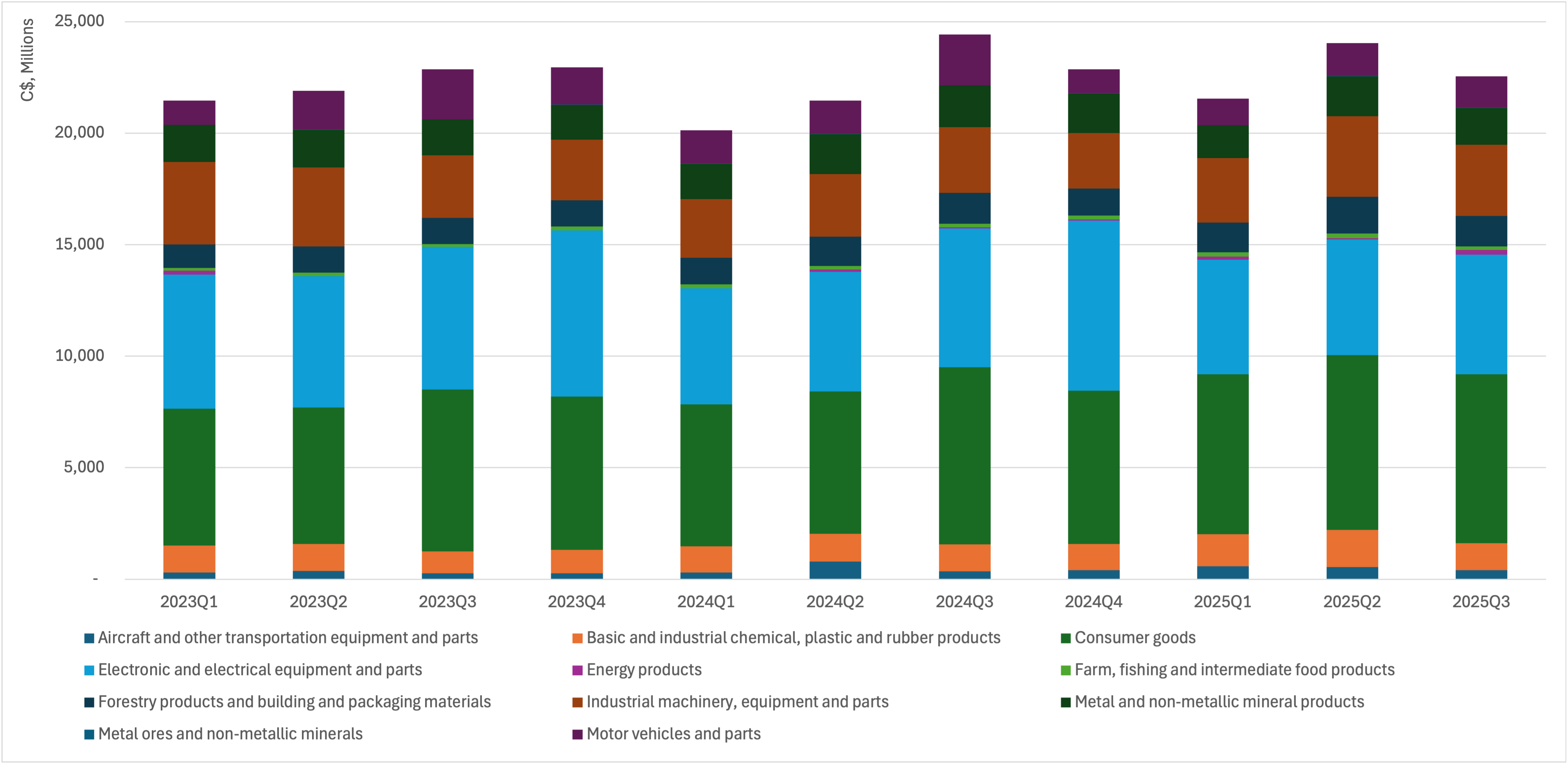

Domestic Exports [7]

Canada’s domestic exports to China in Q3 were dominated by energy products and metal and non-metallic products, accounting for 29% and 25% of Canada’s total goods exports to China in the quarter. Canada exported C$2.03 billion (↑ 80.65% YoY) in energy products and C$1.76 billion (↑ 54.51% YoY) in metal ores and non-metallic minerals to China. There has been a continued year-over-year decline in farm, fishing and intermediate food products since Q4 2024. In Q3, these exports declined by 64.7% year-over-year to C$728.68 million, their lowest level in two years. Overall, sharp declines in agricultural exports were partially offset by strong gains in energy products and metal ores, keeping the overall exports broadly stable year-over-year.

Figure 6. Canada–China Domestic Exports by Product Category, 2023 Q1–2025 Q3 [8]

Figure 7. Canada–China Domestic Exports by Product Category, 2025 Q3 [9]

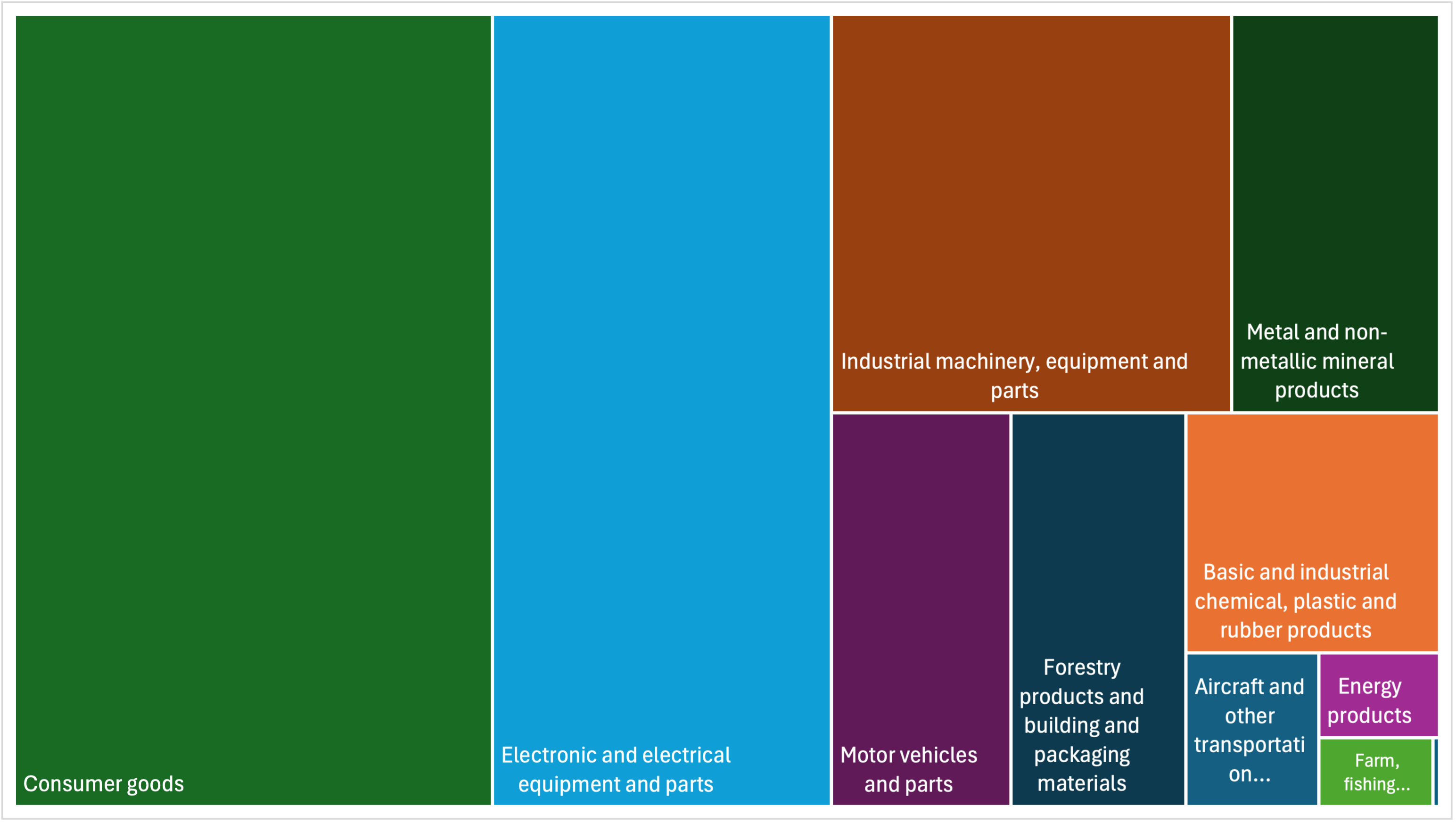

Imports

In Q3 2025, Canada’s imports from China continued to be dominated by consumer goods, electronic and electrical equipment and parts, and industrial machinery and equipment. Together, these categories accounted for 34%, 24%, and 14% of Canada’s total goods imports from China in the quarter, with import values of C$7.56 billion (↓ 4.77% YoY), C$5.37 billion (↓ 13.72% YoY), and C$3.19 billion (↑ 8.35% YoY), respectively. Imports of energy products from China rose sharply, reaching a two-year high of C$204 million, a 309.2% increase year-over-year.

Figure 8. Canada–China Imports by Product Category, 2023 Q1–2025 Q3 [10]

Figure 9. Canada–China Imports by Product Category, 2025 Q3 [11]

Top 3 Products with the Largest Year-over-Year Growth in Exports and Imports:

Exports

- Aircraft and other transportation equipment and parts: ↑ 1060.84% (C$9.9 million → C$114.6 million)

- Energy products: ↑ 80.65% (C$1.13 billion → C$2.04 billion)

- Metal and non-metallic minerals: ↑ 14.25% (C$254.6 million → C$393.3 million)

Imports

- Energy products: ↑ 309.23% (C$50 million → C$204.4 million)

- Aircraft and other transportation equipment and parts: ↑ 14.25% (C$357.3 million → C$408.3 million)

- Industrial machinery equipment and parts: ↑ 8.35% (C$2.94 billion → C$3.19 billion)

Top 3 Products with the Largest Year-over-Year Decline in Exports and Imports:

Exports

- Farm, fishing and intermediate food products: ↓ 64.67% (C$2.06 billion → C$728.7 million)

- Motor vehicles and parts: ↓ 36.94% (C$85.1 million → C$53.7 million)

- Forestry products and building and packaging materials: ↓11.47% (C$900.6 million → C$797.3 million)

Imports

- Motor vehicles and parts: ↓ 37.66% (C$2.27 billion → C$1.41 billion)

- Metal ores and non-metallic minerals: ↓ 30.18% (C$12.2 million → C$8.5 million)

- Electronic and electrical equipment and parts: ↓ 13.72% (C$6.22 billion → C$5.37 billion)

Notable Events

- July 16, 2025: Canada tightens steel import controls tied to China-origin steel, aimed at protecting Canada’s steel industry, including implementing additional tariffs of 25% on steel imports from all non-U.S. countries containing steel melted and poured in China.

- Aug 12, 2025: Following 100% tariffs on Canadian canola meals and oil, and peas, along with 25% tariffs on Canadian seafoods and pork imposed on March 20th, China hits Canadian canola seed with a major provisional anti-dumping duty, announcing a 8% provisional duty on Canadian canola seed, which is a direct hit to one of Canada’s biggest agri-exports to China.

Acknowledgement

This quarterly trade report has been made possible through a collaboration between the Canada China Business Council (CCBC) and The China Institute (TCI) at the University of Alberta.

Authors

Dr. Xiaowen Zhang, Senior Researcher

The China Institute, University of Alberta

Dr. Weisu Yu, Postdoctoral Scholar

The China Institute, University of Alberta

Sources

- Figure 1: Canada–China Bilateral Trade, 2024 Q1–2025 Q3.

Source: International merchandise trade by principal trading partners, quarterly (Table: 12-10-0127-01); customs basis; seasonally adjusted (CAD, millions). Accessed December 17, 2025. - Figure 2: Canadian Exports to China, 2024 Q1–2025 Q3.

Source: International merchandise trade by principal trading partners, quarterly (Table: 12-10-0127-01); customs basis; seasonally adjusted (CAD, millions). Accessed December 17, 2025. - Figure 3: Canadian Imports from China, 2024 Q1–2025 Q3.

Source: International merchandise trade by principal trading partners, quarterly (Table: 12-10-0127-01); customs basis; seasonally adjusted (CAD, millions). Accessed December 17, 2025. - Figure 4: Provincial Trade with China, 2025 Q3.

Source: International merchandise trade by province, commodity, and principal trading partners, monthly (Table: 12-10-0175-01); customs basis; not seasonally adjusted (CAD, millions). Accessed December 17, 2025. - Figure 5: Top 5 Provincial Bilateral Trade, 2025 Q3.

Source: International merchandise trade by province, commodity, and principal trading partners, monthly (Table: 12-10-0175-01); customs basis; not seasonally adjusted (CAD, millions). Accessed December 17, 2025. - Table 1: Year-over-Year Changes in Provincial Trade with China (C$, thousands).

Source: International merchandise trade by province, commodity, and principal trading partners, monthly (Table: 12-10-0175-01); customs basis; not seasonally adjusted (CAD, thousands). Accessed December 17, 2025. - To illustrate Canadian value-added exports, this analysis focuses on domestic exports at the product level. Domestic exports include goods of Canadian origin and goods of foreign origin that have been materially transformed in Canada. Domestic exports accounted for approximately 98% of Canadian merchandise exports to China in 2025 Q3. This approach differs from the preceding overall trade and provincial breakdowns, which reflect the combined total of domestic exports and re-exports. Products are classified according to the North American Product Classification System (NAPCS) 2022.

Source: Statistics Canada, North American Product Classification System (NAPCS), 2022. - Figure 6: Canada–China Domestic Exports by Product Category, 2023 Q1–2025 Q3.

Source: International merchandise trade by province, commodity, and principal trading partners, monthly (Table: 12-10-0175-01); customs basis; not seasonally adjusted; domestic exports only (CAD, millions). Accessed December 17, 2025. - Figure 7: Canada–China Domestic Exports by Product Category, 2025 Q3.

Source: International merchandise trade by province, commodity, and principal trading partners, monthly (Table: 12-10-0175-01); customs basis; not seasonally adjusted; domestic exports only (CAD, thousands). Accessed December 17, 2025. - Figure 8: Canada–China Imports by Product Category, 2023 Q1–2025 Q3.

Source: International merchandise trade by province, commodity, and principal trading partners, monthly (Table: 12-10-0175-01); customs basis; not seasonally adjusted (CAD, millions). Accessed December 17, 2025. -

Figure 9: Canada–China Imports by Product Category, 2025 Q3.

Source: International merchandise trade by province, commodity, and principal trading partners, monthly (Table: 12-10-0175-01); customs basis; not seasonally adjusted (CAD, thousands). Accessed December 17, 2025.